Carbon Credits Are Priced

Whether you are new to the carbon credit trading industry or an experienced professional, you will find that there are numerous factors that affect the price of carbon credits. For instance, how you value your project, the type of project you are implementing, the year of the offset, the country of origin and the certification board can all influence the cost of the carbon. You will also have to consider your company’s internal process of assessing risks and opportunities.

The first step to trading in carbon.credit is choosing a regulated broker. This will allow you to open an account and deposit funds. You can do this by using a bank transfer, e-wallet, or credit card. You will then have to complete a Know Your Customer (KYC) procedure to verify your identity.

You can then choose a carbon credit market. There are a number of options available, including the Emission Trading Schemes, or cap and trade systems. These are regulated by international organizations, which set limits on GHG emissions and cap the total amount of carbon that can be released. This allows businesses to participate in the system and benefit from allocating carbon credits. Companies that do not exceed their carbon limit can sell unused allowances to other businesses.

How Carbon Credits Are Priced

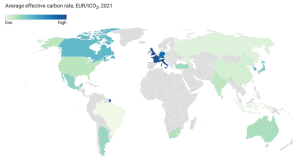

Carbon trading is intended to help reduce the costs of new technologies, while promoting innovation and environmental awareness. There are two ways to price carbon: directly with taxes or indirectly through removing subsidies for fossil fuels. The most common way to price carbon is through a tax. Indirect ways of pricing carbon include removing subsidies for fossil fuels or taxing emissions from certain activities.

While prices vary in the private carbon market, the global carbon market will likely stabilize. As a result, more options will be made available to address climate change. A carbon pricing leadership coalition has called for carbon prices to be between US$40-80 per ton of CO2 by 2020.

The cap and trade system is the most popular option for pricing carbon. It is regulated by the Kyoto Protocol and includes a cap on total levels of GHGs. These caps have been put in place by 45 national jurisdictions in 2018. These caps are used to control the level of total emissions. These caps can be too high and could cause the economy to falter, or too low and cause consumers to pay more for goods and services. It is a tough task to create a cap that balances these concerns.

The World Bank has also set shadow carbon prices. These are not as accurate as the ETS, but they do provide a base price for procuring credits in the market. This is because carbon is seen as a commodity.

You can buy carbon credits in various forms, including tokens or digital assets. You can also buy credits from the project you are working on. Some projects will sell these to investors as a means of funding the project. Regardless of the method, you will have to complete a KYC procedure to make an investment.